Blog

The impact of price on the provision of business training in Jamaica

19 December 2019

Should governments offer business training at free or heavily subsidised prices, or instead charge prices that at least cover the cost of provision?

In many countries, governments typically spend millions of dollars subsidising training. Several rationales are offered for this practice: there is a concern that high prices will prevent poor, and credit-constrained, entrepreneurs from participating; that many owners will not know how useful such training can be for them until they have taken part; and that, because the returns to training are uncertain, risk-averse owners may be unwilling to pay for it. However, critics ask why public money is getting used to provide private benefits to firm-owners, and they note that charging for training can help make such programmes more financially sustainable and avoid distorting the market for private training. Moreover, charging a price may also improve the targeting of these programmes, by attracting those who expect to benefit most from training, as well as the effectiveness, if having “skin-in-the-game” causes entrepreneurs to exert more effort in learning and in applying the lessons to their businesses.

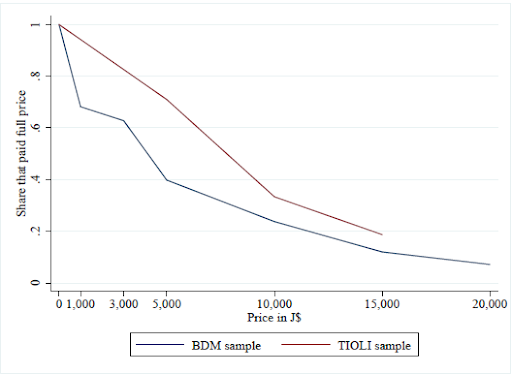

The existing research literature offers little guidance on this question, as it has focused on testing the effectiveness of business training programmes that have been provided for free or at a nominal cost only (McKenzie and Woodruff, 2014). We conducted two experiments with Jamaican entrepreneurs to measure how pricing business training affects demand, targeting, and effectiveness. First, using a sample of 457 entrepreneurs, we use a version of the Becker-DeGroot-Marschak (1964) (BDM) mechanism to elicit willingness to pay for training, and then randomise prices offered to assign entrepreneurs to training if the price offered is below their maximum willingness to pay. Second, with a sample of 374 entrepreneurs we randomised take-it-or-leave-it (TIOLI) offers at four different price levels. In both cases, the training offered was a 40-hour training programme that combined training on business practices with classes on teaching personal initiative. The cost of providing the course was J$20,000 (approximately US$150).

What are the impacts of higher prices?

- The majority of entrepreneurs do have a positive willingness to pay for training. This is an important finding in the current context in which business training is typically offered for free, and does suggest some scope for providers to help recover some of the costs of offering training.

- Charging higher prices dramatically reduces the number of entrepreneurs who will take up training. We find that the demand curve for business training is fairly steep, as shown in the figure below. Only 68% of the BDM sample paid for training at a nominal price of J$1,000 (5% of the full cost), but this then drops to 40% at J$5,000, 24% at J$10,000 (half price), and only 7% at J$20,000 (full price).

- Charging higher prices screens out poorer business owners, more risk-averse business owners, and those who do not expect to benefit as much from the training. The TIOLI sample was richer than the BDM sample, which helps explain their higher demand. However, credit-constraints do not seem to be the main issue here, since offering entrepreneurs the ability to pay for the course in installments did not increase take-up.

- Charging more than a nominal fee does cause those who buy the course to attend more classes. Entrepreneurs paying the nominal fee of J$1,000 only attend 7 out of 10 classes on average. Charging a fee of J$5,000 or more increases this by 1 to 2 classes, even conditional on willingness to pay, suggesting that a sunk cost effect does operate and induce more effort. However, the much larger impact of price on attendance comes through the extensive margin, whereby higher prices make entrepreneurs much less likely to buy the course at all.

We then attempt to measure the impact of the course on business knowledge, business practices, and profits and sales. Our follow-up survey suffered from high attrition, which limits our ability to detect impacts here. We find some improvements in business practices and business knowledge, but no evidence that these are any larger for entrepreneurs paying higher prices, and a lack of statistical power also means we cannot rule out the possibility that those who pay higher prices do benefit by a lot more.

These results offer some support to both sides of the pricing argument – charging higher prices does reduce how many firms will get training, and is especially likely to screen out poor entrepreneurs, but also might get firms to take the training more seriously. The optimal price for governments to charge may therefore lie somewhere in between free or nominal cost and market price. In particular, governments and funders of entrepreneurship training could compute the optimal price to charge by applying different weights to equity-related goals (e.g., how many people are served, how many of them are poor) and efficiency-related goals (e.g., whether those served are the ones for whom impacts are greatest, cost recovery and effectiveness, etc.).

References:

Becker, G., M. DeGroot and J. Marschak (1964) “Measuring utility by a single-response sequential method”, Behavioral Science 9: 226-32.

McKenzie, D. and C. Woodruff (2014) “What are we learning from business training and entrepreneurship evaluations around the developing world?”, World Bank Research Observer 29: 48-82.